A Rare Class A Opportunity

for Accredited Investors

1176 Mickley Rd, Whitehall, PA 18052

Premier Self-Storage Investment in the #1 Mid-Sized Market in the U.S.

TOP-TIER MARKET

UNMATCHED LOCATION

EXCEPTIONAL RETURNS

BREAKING NEWS

Financing Secured

Find Out What It Means For You!

Watch the Investment Update Replay

Missed the live session? No problem—access the full replay now!

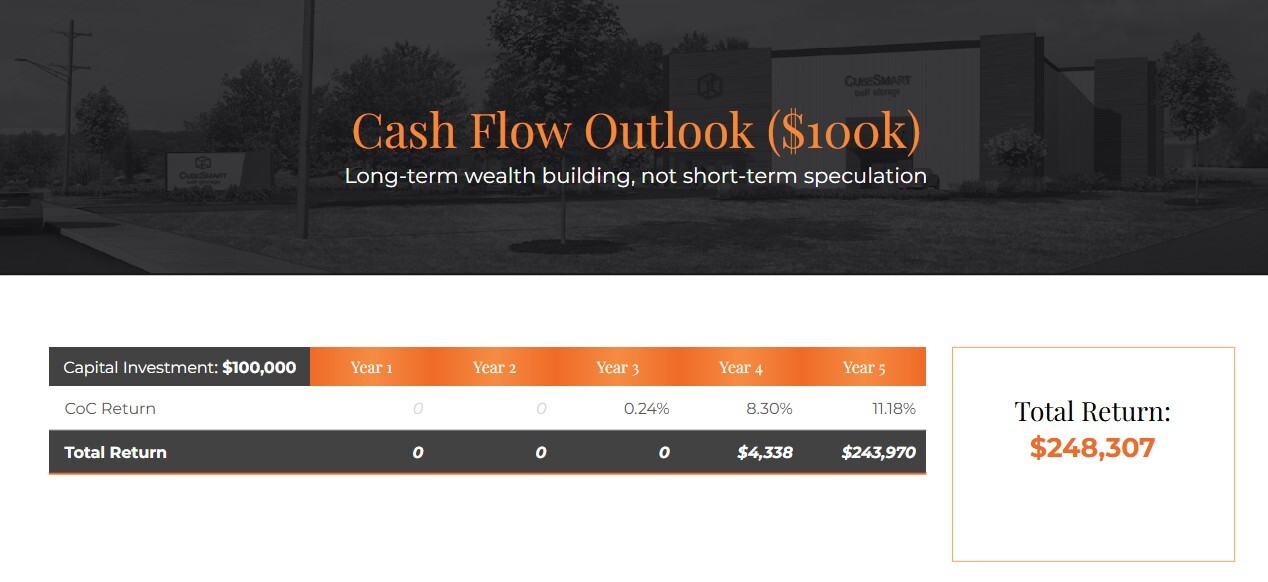

Updated Sample Investment

Why Whitehall & the Lehigh Valley? Why Now?

It’s not just the project that makes this an incredible opportunity—it’s also the market.

The Lehigh Valley is the #1 ranked midsize market for economic growth in the U.S. and continues to attract new businesses, residents, and development at an unprecedented rate.

-

#1 Nationally in Economic Development for Midsize Markets

-

7.5% Population Growth Since 2010 – Outpacing Pennsylvania’s 2.1% growth

-

Logistics & Manufacturing Hub – Home to Amazon, FedEx, and Air Products

-

Thriving Real Estate Market – Over 7,440 new residential units under development

-

Undersupplied Self-Storage Market – Below the national average in SF per capita

With high barriers to entry and an increasing population, Whitehall is a rare investment opportunity with a strong risk-adjusted return profile.

MEET AIR:

Your BETA Smart Investment Guide

What is AIR?

Our cutting-edge AI Investor Relations assistant designed to answer your investment questions 24/7.

How AIR Helps You:

- Provides full insight into the PPM and offering for instant answers about your investment opportunity

- Guides you to key resources and financial insights

- Directs you to our landing page for next steps

The Lehigh Valley's

Booming Economic Development

Not Just a Premier Location—A Premier Corridor for Growth

Strategically positioned along a high-traffic retail corridor, this site offers unmatched visibility and access, making it an ideal location for long-term success.

- Positioned in the heart of Lehigh Valley’s busiest retail hub, surrounded by the highest traffic national retailers like Walmart, Lowe’s, and Home Depot.

- Exceptional visibility and accessibility from major roads, ensuring consistent traffic.

- 35,892 VPD MacArthur Road

- 13,238 VPD Mickley Road

- Located near three grocery stores within 1-mile radius, driving regular consumer traffic.

High Demand, Low Competition—Maximizing Investor Opportunity

Capture Demand in an Underserved Market

- The 3-mile market supply is only 6.4 SF per capita total storage and 3.1 SF for climate control, including our project and development pipeline—well below the national average of 8.5 SF.

- The 3-mile market can support an additional 672,000 SF, or EIGHT full-sized storage locations before being considered at supply/demand equilibrium.

- No other Class A self-storage facility within 1 mile.

- Only three competing Class A facilities in the 3-mile radius, all inferior and with less favorable locations, property conditions, and tenant amenities.

Schedule Your Personal Consultation

Have questions? Our Investment Relations team is ready to guide you through the opportunity and answer any questions you have.

Prime Location, Proven Demand, and a Class A Asset

Designed to Deliver Exceptional Value to Investors

High Visibility & Strategic Location

- Prime Retail Corridor: Located in Whitehall’s busiest retail hub, surrounded by national retailers like Walmart, Lowe’s, and Home Depot.

- Unmatched Visibility: Exceptional road frontage and accessibility for maximum tenant traffic.

Unmet Demand & Limited Competition

- Low Market Saturation: Only 6.4 SF per capita total storage and 3.1 SF for climate control, far below the national average.

- Clear Demand: No competing Class A facilities within a 1-mile radius and only three within 3 miles.

Thriving Population, Thriving Investments

- Thriving Demographics: Over 128,000 residents within 3 miles, with a high 52% renter occupancy rate.

- Sustained Growth: As the fastest-growing mid-sized market in the U.S., the Lehigh Valley's ongoing residential development continues to fuel future demand.

Premier Class A Asset

- Class A Facility: Five-story climate-controlled design with premium amenities and tenant-friendly features.

- Institutional Management: REIT Management (CubeSmart) for best-in-class service and efficiency.

Fast Track to Returns

- Fully Approved Project: Permits and shovel-ready by March.

- REIT Lease Up Strategy: CubeSmart targets 36 months for occupancy stabilization, 48 months to rental rate stabilization.

Built-In Customer Base

- Proven Success: Average occupancy rates exceed 92% and achieving $20+ SQFT across existing facilities in the region.

- High Renter Demand: 52% of area residents rent their homes, driving consistent storage needs.

Ways to Invest

Join the growing number of investors leveraging strategic funding options to build wealth through self-storage.

Here are four smart ways to invest:

Reposition

Your IRA

Over 40% of our investors have repositioned their IRA funds into self-storage, taking advantage of tax benefits and steady returns.

Leverage

Home Equity

Tap into the value of your home with a HELOC (Home Equity Line of Credit) to put your money to work in a high-performing asset class.

Optimize

Your Portfolio

Reduce risk by shifting funds from high-risk investments into self-storage, a historically stable and recession-resilient sector.

Grow

With Cash

Move idle cash into a high-yield opportunity and put your money to work generating passive income and long-term growth.

Tax Advantages of Investing

Investing in self-storage not only builds wealth but also offers significant tax benefits. Here's how you can maximize your investment.

- Common Equity Investment: Enjoy potential tax-deferred growth and long-term capital appreciation while benefiting from depreciation and other tax efficiencies.

- Cost Segregation Benefits: A cost segregation study will be conducted upon project completion, offering substantial tax advantages to qualifying investors by accelerating depreciation and reducing taxable income.

Get in on This Exclusive Opportunity

Invest Now

Complete a short form to reserve your spot and receive a callback from our investment team.

Schedule a Call

Discuss how this opportunity aligns with your financial goals with our investment team.

There is a reason we have a 90% Reinvestment Rate

From a Single Triplex to a $100M Investment Platform

Hearthfire began not as a business plan, but as a strategic pivot. Corinn’s background in opera demanded relentless dedication, yet financial instability in the arts led her to rethink her path. A simple decision—turning a triplex into an investment instead of a home—set everything in motion.

What started as a personal investment grew into a thriving community of 250+ investors, turning savings into wealth-generating assets. Hearthfire’s disciplined, strategic approach led to a shift from residential real estate to self-storage, leveraging its stability, operational efficiency, and recession-resistant strength.

This commitment to smart investing is why 90% of our investors reinvest.

$150M+

ASSETS UNDER MANAGEMENT

30+

YEARS IN FINANCE & WEALTH MANAGEMENT

250+

INVESTORS

90+

YEARS IN SELF-STORAGE

1M

CUMULATIVE NRSF

30+

YEARS IN TECHNOLOGY

"My opinion of the Hearthfire brand: there aren't lots of bells and whistles or sales pitches, but the results seem to consistently outperform expectations. It's not what you normally experience in the investing world - instead of a fancy sales pitch and overhyped value proposition, you receive plainspoken projections that the company typically exceeds, and you sometimes wish you had invested more in the first place. "

"I guess that was eight or nine years ago, that first property. It was easy and a wonderful return. I just saw from there the company grow and turn into Hearthfire. I have been fortunate that I got to know [Hearthfire] from the get-go and been invited to participate in all the initial offerings and have done quite well."

Secure Your Spot Today

Don't miss this exclusive opportunity to invest in a premier Class A self-storage asset. Positons are limited—act now to reserve your investment.

WHY WE LOVE THIS DEAL

A Culmination of Everything We've Built

The Mickley Road self-storage project in Whitehall, PA isn’t just another deal—it represents the most significant investment Hearthfire has ever undertaken.- Largest Development Yet: Whitehall is Hearthfire’s biggest project in terms of scale, cost, and investment potential.

- De-risked Development: The toughest part of real estate—land acquisition, entitlements, and approvals—has already been handled.

- Institutional-Grade Investment: This isn’t just about finding an opportunity; it’s about curating a premier investment for the community that has grown alongside us.

The turning point came when Sergio stood on the site, surrounded by the strongest commercial corridor in the region. The location was too good to pass up—a five-story, Class A self-storage facility positioned in a booming market with high demand and limited competition.

Expertly Designed to Outperform—A Premier Class A Asset

- Five-story Class A climate-controlled facility with two subterranean levels.

- Designed to maximize efficiency and tenant convenience, offering premium storage options.

- REIT management (CubeSmart) to ensure top-tier operations and service quality.

Shovel-Ready & De-Risked—Delivering Certainty

The Hearthfire team identified the land in 2022, and is only now bringing this project to investors, having brought it through significant pre-construction risk.

- Permits in final review

- Construction shovel-ready in March

- CO by Q2 2026

- Streamlined timeline allows for lease-up and stabilization within 36-48 months.

.png?width=600&height=300&name=Dev%20Timeline%20(1).png)

Ready to Join the 90% of Investors who keep coming back for consistent reliable returns?

Speak to your partners at Hearthfire Holdings to secure your spot in this unique investment opportunity.

What happens if the property does not meet 93% occupancy? What is the lowest acceptable occupancy rate?

Occupancy levels in self-storage are managed dynamically through pricing. If the facility is not reaching 93% occupancy, we adjust pricing and concessions to drive lease-up. The lease-up strategy is based on velocity, with an expectation to rent about 5% of the units per month. Concessions, such as introductory rates or free months, attract customers. Once at 80-85% stabilized occupancy, pricing strategy shifts from lease-up to revenue maximization. During peak summer seasons, occupancy ideally reaches 95%, while some decline is expected in winter. There is no absolute "lowest acceptable" occupancy rate because we can always adjust pricing to drive demand. Self storage properties typically achieve break-even occupancy at around 60-75%

Was the newly built storage location on the Lehigh River (potential Class A) included in the competition analysis?

Yes, all competing properties, including those in the pipeline, were analyzed. We use data from CubeSmart, Extra Space, Public Storage, and internal sources, including our acquisitions and asset management teams. We also conduct direct market research, including secret shopping, to confirm market conditions. The feasibility study attached to the legal documents confirms that this market can support multiple high-quality self-storage facilities without oversupply concerns.

Is there a possibility of refinancing the loan if interest rates decrease during the 5-year hold period?

Yes, refinancing is an option if financial conditions warrant it. Several value-creation opportunities exist, including securing entitlements, completing construction, and achieving stabilized occupancy. If market conditions allow, we may refinance to return investor capital earlier. However, the business plan is to hold for five years and potentially sell to a REIT or private equity firm looking for stabilized cash flow. If refinancing becomes a viable option, investors would be consulted on the best course of action.

Is there potential to hold the property beyond five years if financial performance supports it?

Yes, while the business plan targets a five-year hold, we have the flexibility to extend if it benefits investors. If returns justify continuing operations instead of a sale, we could opt for a long-term hold strategy. This could involve refinancing to return capital while maintaining ownership or transitioning the asset into a long-term cash-flowing investment.

Can you clarify Tier 1 and Tier 2 LP Partner Return Assumptions?

The investment structure includes a 10% preferred return, meaning investors receive the first 10% of profits annually before any profit-sharing with the general partner. Returns are structured as follows:

- Up to 10% IRR: 100% to investors.

- 10% - 18% IRR: 75% to investors, 25% to the general partner.

- Above 18% IRR: 50% to investors, 50% to the general partner. This tiered structure aligns incentives, ensuring the general partner benefits primarily when investors receive strong returns.

What is the contingency plan for construction issues? Are the two subfloors part of the climate-controlled area?

Yes, the entire facility, including the subfloors, will be climate-controlled. The construction budget includes a 7% contingency to cover unexpected costs. Additional buffers exist at multiple levels:

- Initial high-level estimates ensure conservative underwriting.

- Contractor bids and final pricing provide further refinement.

- An additional $200,000 buffer was identified through budget refinements.

- Worst-case scenarios allow for adjusting construction phasing or alternative capital sources. By maintaining these safeguards, we ensure cost overruns do not negatively impact the investment.

Why did Hearthfire choose Whitehall, PA, as its location? Are there any economic development incentives or housing trends supporting this decision?

Hearthfire chose Whitehall, within Lehigh Valley, PA, due to a strong infrastructure, strategic location, and a steadily growing population, which combined make it an ideal environment for sustained investment and economic development.

The Lehigh Valley offers a compelling investment landscape due to its strategic location and economic strength.

Key highlights include:

- Proximity to Major Markets: Close to both New York and Philadelphia, offering access to major markets without the high costs.

- Attractive for Logistics and Business Growth: Companies like Amazon and FedEx are establishing operations here, drawn by the region’s lower costs and logistical advantages.

- Population Growth: Expected to grow by 100,000 residents by 2050, driving continued demand for housing, services, and storage.

- Strong Economic Performance:

- $55.7 billion GDP in 2023.

- $8.1 billion manufacturing sector, showcasing robust growth potential. - Job Creation & Major Employers:

- Job growth is accelerating in logistics, manufacturing, healthcare, and e-commerce.

- Major employers such as Air Products and Mack Trucks are expanding their operations in the area.

- Unemployment is at a 20-year low, creating a stable and attractive environment for investment.

Here are some recent headlines highlighting the region’s growth:

- Lehigh Valley Hottest Small Market of 2024 (CREDaily)

- Germany-based manufacturer moving hydraulic valve production from China to facility in Lehigh Valley

- Lehigh Valley GDP grows to record $55.7 billion

- an increase from previous, Lehigh Valley's Economy Hits Record $50 Billion GDP

- These are the Bethlehem development projects to watch for in 2025

- In the pink: Experts see continued growth for Lehigh Valley economy

- Lehigh Valley: Phenomenal Manufacturing Success

Who is the primary target customer?

Our primary customer base consists of:

- Residential Movers & Homeowners: Individuals relocating, downsizing, or in need of temporary storage during life transitions.

- Apartment Renters: With increasing multifamily developments in the area, tenants often require additional storage solutions.

- Small Businesses & Contractors: Local entrepreneurs, tradespeople, and e-commerce businesses need storage for inventory and equipment.

Note that in our immediate service area (1- and 3-mile radius), there is a 52% renter population. (Hearthfire targets a minimum of 30%) This - plus the full occupancies at competitors in the 3-, 5-, and 10-mile radii - underscore the demand for storage.

Our customer mix reflects the broader demographic and economic trends in the Whitehall market, ensuring a steady demand for storage solutions.

Is the preferred return cumulative?

Yes.

What is the difference between IRR and Development Yield in this context?

Both metrics assess investment performance but serve different purposes:

- IRR (Internal Rate of Return): This represents the annualized return on investment over the project's entire life cycle, factoring in all cash flows (investment, operating income, and eventual sale). It accounts for the time value of money and is often the key metric for long-term investors.

- Development Yield (or Yield on Cost): This measures the project's initial return upon stabilization, calculated as Net Operating Income (NOI) / Total Development Cost. It provides a snapshot of profitability based on construction and lease-up costs before considering appreciation or exit valuation.

In this project, IRR helps assess the overall attractiveness of the investment over time, while Development Yield provides insight into the project's operational efficiency at stabilization.

The total fundraising target is $7M. How much has been raised so far?

We have raised over $1MM funded and over $3mm in committed and interested investors.

The land has already been purchased by the General Partner (GP). Was a loan used to finance the GP's investment?

Yes, from our Debt Fund. That will be paid off with the equity from the raise.

How much is the GP/Sponsor willing to invest in the project?

The GP has invested in the project by carrying all the construction costs to date, since 2023, and by personally guaranteeing the loan. Across our portfolio we average 7-10% of total equity.

Based on past projects, what is the typical construction cycle duration?

- Self storage construction typically takes between 12-16 months to complete, which is far less time than the majority of all other real estate construction. In addition, self storage builds have many components that are modular and standardized. For example, the storage units themselves are ordered and delivered to be assembled using simple and standard methods.

- The Whitehall construction will be completed June 2026.

- This is not based on past projects, this is based on the actual project schedule, since the GC is breaking ground in March.

In the development cost slide, the interest reserve is listed as approximately $1M. Is this a requirement from the bank?

Yes, all lenders require enough funds to cover the interest during the construction period.

When do you plan to start issuing preferred returns?

When the project is generating sufficient cash flow to meet DSCR and have distributable cash.

Is your firm vertically integrated?

No - we use 3rd party managers. See this press release

Have all necessary permits been obtained?

Yes

The terminal cap rate assumption is 5.5%. Is this based on a specific model or benchmarked against industry peers?

- The cap rate of 5.5% is based on a conservative rate typical for the market and type of asset we are building. Even with high interest rates, most properties of this caliber are trading closer to 5% cap rates.

- Our model has a sensitivity analysis that calculates returns at different terminal cap rates, see that here:

What is your projected construction period beyond the initial two-year timeframe?

The construction will be completed June 2026.

Is there a contingency budget for cost overruns, and how is it structured?

Yes. The construction contingency is 7%.

Who are the primary lenders, and what are the key loan covenants?

We have multiple term sheets, here are two with the highlights.

Stearns Bank:

- Full due diligence review of transaction

- Receipt and review of acceptable appraisal, environmental report, and ALTA Survey

- Stearns Bank Committee, CDC, and SBA Approval

- Stearns Bank to pay the required CDC Loan Fee of $41,750

PSG:

- Developer Fee funding: 50% pro rata to project progress as part of construction draws, 25% on TCO, 25% on CO + 10% economic occupancy milestone

- Satisfactory GC (fully Bonded) and cost verification/budget

- Full Recourse from Key Principals/Sponsors Subject to receipt and review of financial statements

- Borrower/Guarantors to show 10% post-closing liquidity and 100% net worth with maintenance requirement.

How could current administration policy impact the project, such as immigration and tariffs.

While these factors can influence the broader construction industry, our approach to planning, budgeting, and contractor selection ensures we are well-positioned to mitigate risks and maintain project execution as planned.

- Pre-Priced & Secured Materials: A significant portion of the materials required for our project has already been priced and, in many cases, acquired by our construction team. This minimizes exposure to potential cost increases resulting from new tariffs or supply chain disruptions.

- Stable Contractor & Workforce Strategy: We do not engage with contractors who rely on labor that could be significantly affected by immigration policy changes. Additionally, our general contractors have a stable workforce and established subcontractor relationships, ensuring that labor availability does not pose a risk to the project timeline.

- Inflation & Tariff Allowance: For Whitehall, we have a separate allowance set aside specifically to account for inflation, tariffs, and other unforeseen cost increases. While it is difficult to predict the exact total impact of such policies, this project came in under budget at Guaranteed Maximum Price (GMP). As a result, we were able to set aside an additional allowance to further buffer against these potential expenses.

- Budget Contingency for Unknowns: Beyond the specific inflation and tariff allowance, our project budgets also include a contingency to account for any unforeseen circumstances, including potential cost variances tied to macroeconomic or policy changes. This ensures we have the financial flexibility to adapt while protecting projected returns.

- Diversified Supplier & Contractor Network: We work with multiple suppliers and contractors to reduce dependency on any single source. This allows us to pivot if needed and avoid unnecessary exposure to tariff-related cost increases.

- Historical Adaptability & Project Resilience: Hearthfire has successfully executed development projects through varying market conditions, including inflationary periods and supply chain disruptions. Our experience in navigating evolving economic and policy landscapes reinforces our confidence in our ability to deliver this project as planned.

- Project Timeline & Flexibility: We are actively monitoring any policy changes that could impact construction and have structured our approach to allow for adjustments if necessary. This flexibility ensures that any emerging risks can be managed efficiently without delaying the project.

Overall, while macroeconomic and policy shifts are always a consideration in real estate development, our disciplined approach—combined with strategic material procurement, stable labor partnerships, dedicated inflation allowances, and prudent contingency planning—ensures that we are well-positioned to execute this project successfully.

Who are the primary customers of self-storage facilities?

Here's an overview of some key demographics and their motivations:

1. Age Groups:

- Generation X (Aged 40–55): Approximately 23% of Gen X individuals rent self-storage units, making them the most prevalent users. Home

- Millennials (Aged 24–39): This group accounts for about 25% of storage users, up from 20% in previous years. Notably, nearly a quarter of non-renting millennials plan to use self-storage in the future, often to facilitate moving. Market Share

2. Primary Motivations:

-

Lack of Space at Home: Around 40% of users rent storage units due to insufficient space in their residences, a slight increase from previous years. Home

-

Moving or Relocating: Approximately 34% utilize storage during transitions such as moving, with millennials particularly inclined to rent storage to assist with relocations. Market Share

-

Decluttering: The trend of decluttering has led 42% of respondents to rent storage units to manage household items, especially with the rise of remote work making home spaces more multifunctional.

3. Stored Items:

- Furniture: About 34% of users store furniture, including items like dining tables, chairs, and small cabinets.

- Clothing: Approximately 22% store clothing, with renters more likely than homeowners to use storage for wardrobe items. Home

4. Housing Status:

- Renters: Individuals in rental housing are significant users of self-storage, often due to smaller living spaces and higher mobility. Areas with high renter-occupied housing percentages typically exhibit increased demand for storage solutions. Radius+

5. Business Use:

- Small Businesses and Entrepreneurs: A growing segment of self-storage clientele includes small business owners who utilize storage units for inventory, equipment, and documents, finding it a cost-effective alternative to traditional warehousing. Home

How stable is the need for self-storage assets in the local market given uncertain economic conditions?

Despite economic fluctuations, self-storage remains a stable asset class due to its resilience during market shifts and changing housing dynamics. The demand for storage solutions often increases during economic transitions, making it a reliable investment choice.

How does Hearthfire address fluctuating interest rates?

- Variable Rates During Construction: We begin with variable interest rates during the construction phase, which lets us benefit from current market conditions as they evolve.

- Interest Reserve: To ensure that rate fluctuations don’t disrupt our project’s cash flow, we allocate an interest reserve specifically to cover the cost of interest during the construction period. This reserve acts as a buffer, guaranteeing that all interest obligations are met even if rates shift unexpectedly.

- Rate Fixing Within 36 Months: Recognizing the need for long-term predictability, we commit to fixing the interest rate within 36 months. This strategy secures a stable rate for the remainder of the project, mitigating the risk associated with ongoing market volatility.

What are the risks associated with real estate investments in the self-storage sector?

Our self-storage investments limit income loss through customer damage and lien protections. Additionally, leveraging multiple rental income streams from customers enhances the resilience and profitability of our projects.

Is this investment liquid, and what is Hearthfire's credibility and track record?

This investment is considered illiquid, designed for long-term returns. Hearthfire's credibility is reflected in our 90% reinvestment rate, strong family and friends' support, and our commitment to safeguarding investors' funds with a personalized approach.

Is the self-storage sector profitable and viable for long-term investments?

Despite concerns about oversaturation, the self-storage sector continues to experience high demand driven by population growth, urbanization, and changing lifestyles. Industry studies indicate sustained demand outpacing supply, making self-storage a promising investment opportunity.

What about regulatory, entitlement, zoning, and building code risks for the project?

Hearthfire has acquired the property with land permitting, development approvals, and plans in place. We have submitted permit plans to the city for review and are scheduled to commence construction shortly after receiving permits, ensuring project continuity and compliance. We expect to have permits in hand by Q1 2025.

Can I trust the expertise of your team?

Absolutely. Our team brings over 100 years of combined experience in commercial real estate, with a track record of leading multi-billion-dollar transactions across diverse sectors. This institutional-level expertise ensures unparalleled value and strategic insight to drive our company's success. Additionally, our leadership has firsthand experience owning and managing properties within these markets, understanding their unique needs and dynamics.

Can I trust in the effectiveness of your strategy?

Our strategy is built on a foundation of market ownership, forward-thinking location choices, and a keen understanding of economic trends. We dominate our market, strategically position ourselves near key infrastructures like airports to block out competition and invest in areas with promising future development plans. Detroit's resurgence further validates our approach, leveraging existing undersupply for maximum returns. Our cost-effective building approach in areas with lower land bases ensures substantial profitability and flexibility. Despite higher interest rates, the area's income levels support alternative revenue streams like storage rentals, backed by psychological trends in consumer behavior. Ultimately, we build where demand is high and needed most.

Can I trust that you have my best interests at heart?

Our investors are not just partners; we are a dedicated family committed to ethical practices and mutual success. Our reinvestment rate is aligned with sustainable growth objectives, ensuring ongoing prosperity for all stakeholders.

Still Have Questions?

Our Investment Relations team is ready to guide you through the opportunity and answer any questions you have.

.png)

.gif)

.png)